So everyone has heard the rules about spending 15% on retirement, 30% on your home, 15% on student loans . . . I thought I would add all of those up one day and, indeed, if you look around for a few minutes you can find enough recommendations that you exceed 100%.

Fortunately, there is great news for those who have a ton of student debt. This is a touchy subject for many. My wife and I have about $250,000 in student loans that we accrued in chiropractic school. Other chiropractic students leave with $180,000 in debt for a single DC degree, so at times we joke that we got a buy one get one half off deal. Several years ago, interest rates were very low, 1-2% low, but all of our loans were fixed at 6.8%, the maximum. We did NOT take the grad plus loans and instead decided to live within our means. We lived in a one bedroom apartment, had several work study jobs, paid for our daughters birth without using Medicaid, cooked our own meals, and lived an otherwise modest life. We had no previous debt.

While I disagree with the exorbitant lifestyle choices some of my colleagues made, the real bad guys are the schools, and probably the federal government for making such cheap student loans available. All that money flowing into private, for-profit schools . . . what did they think would happen. Tuition rose every year from $5000 a quarter to $7000 a quarter before we graduated. One year the tuition increase email said the economy was rough . . . so they were raising tuition, huh?

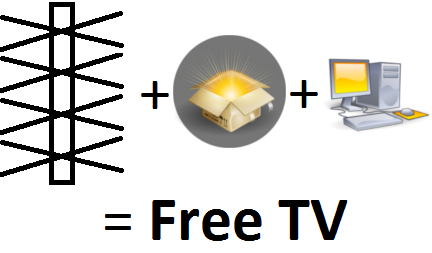

Now, to bring it all together, there is a great program called Income Based Repayment. Student Loan payments were capped at 15% of your *discretionary* income. Now they are capped at 10% of your discretionary income. Discretionary income by the way is the income remaining after you subtract your poverty level. For example, if the poverty level for our family was $20,000 and I made $30,000 that year, my payments would be capped at 15% of $10000, or $1500. If you make less than your poverty level, your payments are $0.

You may be thinking well that’s great the payment is low, but I’ll never pay off my student loan! You would be quite correct, in many cases you may end up paying less than the interest accruing on your loan(called negative amortization).

The second caveat to the story is that your debt would be forgiven in 25 years! Scratch that, Obama made it 20 years. (On a side note, you can also have your student loans forgiven after 10 years if you work in a public service job) The only catch is that after those 20 years, you have to pay income taxes on your student loan + interest. There is H.R. 365, that intends to remove loan forgiveness as a form of income, but it has to pass to be put into effect. This would save borrowers from a year of very high taxes. Of course, you do have 20 years to save for that year that may be high in taxes, like we are.

Income Based Repayment – Student Loans

10% of you discretionary income for 20 years, then forgiveness with some taxes . . . maybe. Sounds great. Disabilities and impairments aside, nearly anyone with student loan debt should have no problem forking over 10% of their discretionary income.

Here is a calculator to see if you qualify and how much your monthly payments would be.

So the point of the article? Check out if you qualify for Income based repayment. Depending on the structure and amount of your student loan you may be able to save hundreds, or even thousands of dollars per month.

My advice, DO NOT DEFAULT on your student loans. Call and explain your situation. It took months to get switched to income based repayment. Everything was going great and then we received a bill for the 10 year repayment amount. When I called they seemed to have no idea I ever even applied for income based repayment, yet I was holding confirmation letters in my hand. Long story short, I had to request a forbearance for that month and resubmit paperwork 2 more times.